Recently, the African fintech space was buzzing with drama, and it was all thanks to Cenoa, who decided to take a bold (some might say risky) shot at Chipper Cash on X. Their tweet wasn’t just a casual mention—it was a direct callout, comparing the two platforms and making it clear why they think they’re the better choice.

What Happened?

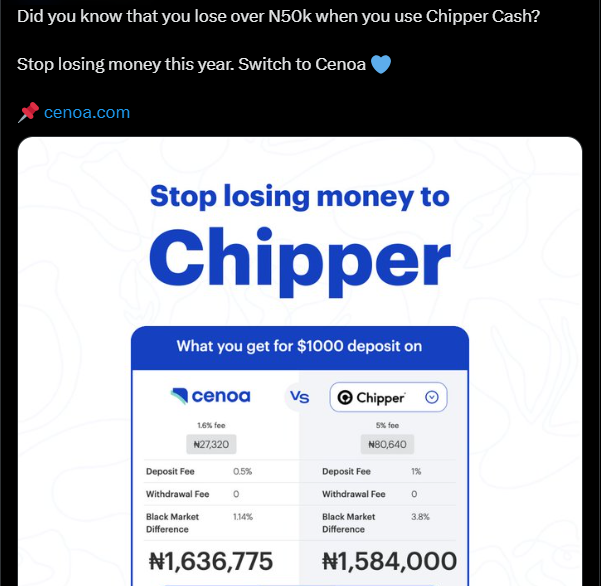

Precisely on 17th January, Cenoa decided to promote their services by calling out Chipper Cash in a tweet. Here’s what they said:

This tweet wasn’t subtle. They were clear about their intentions: to tell the world why they think they’re better. In startup terms, this is called “demarketing,” a bold strategy where one company highlights the flaws of another to boost its own appeal.

Naturally, people had thoughts about it. X lit up with reactions, ranging from laughs to outrage. The Reactions:

Why This Matters

Okay, so why is this even a big deal? It’s because this isn’t just about two fintech companies beefing on Twitter. It’s a window into how startups compete—and sometimes clash—in the fast-growing African fintech market.

Fintech companies like Chipper Cash and Cenoa are vying for the same users: people who need simple, fast, and affordable ways to move money. And let’s be real, the stakes are high. The more users they attract, the more funding they can raise, the more market share they can own.

But here’s the thing: calling out your competition isn’t just risky—it can backfire. Some users may see it as petty or unprofessional. Others might start comparing the two services out of curiosity, which isn’t always what you want if your competitor has an edge.

The Good, The Bad, and The Risky

Here’s a quick breakdown of the pros and cons of what Cenoa did:

- The Good:

Attention Grabber: Let’s face it, the tweet worked. People are talking about Cenoa now more than ever.

Creates Curiosity: Some folks will now check out Cenoa just to see what all the fuss is about.

Competitive Spirit: A little healthy competition isn’t always bad—it can push companies to do better.

- The Bad:

Unprofessional Vibes: Some users might feel like this was unnecessary or mean-spirited.

Free Promo for Chipper: Let’s not forget, every time you mention your competitor, you also shine a light on them.

- The Risky:

What if Chipper Cash Fires Back?: If Chipper responds with a counter-campaign (or even receipts proving their strengths), it could shift the narrative.

User Backlash: People love startups that focus on value, not shade.

Hot Take From A Marketing Professional

To better understand whether Cenoa’s tweet was a smart marketing move or a potential misstep, we looked at insights from Lade Falobi, a marketing professional whose perspective sheds light on how this kind of strategy is viewed in the industry. She also referenced professional advertising guidelines to back it up, ensuring we understand the rules that govern such tactics in Nigeria.

According to Lade, Cenoa’s approach aligns with a popular marketing tactic known as demarketing. This strategy involves directly comparing your product to a competitor’s, emphasizing why yours is the better option. From a marketing standpoint, this isn’t inherently unethical—as long as the claims made are factual, not misleading, and comply with advertising regulations.

In Nigeria, ads are regulated by the Advertising Regulatory Council of Nigeria (ARCON), which replaced the Advertising Practitioners Council of Nigeria (APCON) in 2022. Lade emphasized that ARCON’s guidelines are designed to ensure that marketing campaigns remain truthful, fair, and responsible. While demarketing is allowed, any misleading or false claims could lead to penalties, making it crucial for brands to tread carefully.

This additional layer of regulation highlights why marketing strategies like this one require a delicate balance—grab attention, but don’t step outside the boundaries set by ARCON. So, while Cenoa’s tweet might seem bold, it also carries the risk of scrutiny if the claims are seen as exaggerated or inaccurate.

Our Take

Honestly? Cenoa’s strategy is bold, no doubt about that, but it’s also walking a tightrope. The question is: will users respond positively to this kind of marketing? Or will they stick with Chipper because they don’t like the drama?

We hope this doesn’t set a precedent where fintech companies spend more time throwing shade than solving real user problems. After all, at the end of the day, it’s the users who win when companies focus on delivering value.

Your Take?

So, is Cenoa being bold and innovative? Or did they cross the line? Let us know in the comments or join the conversation on Twitter!

And hey, if you’ve used both Cenoa and Chipper Cash, tell us—who’s better and why?